Sales Tax reporting

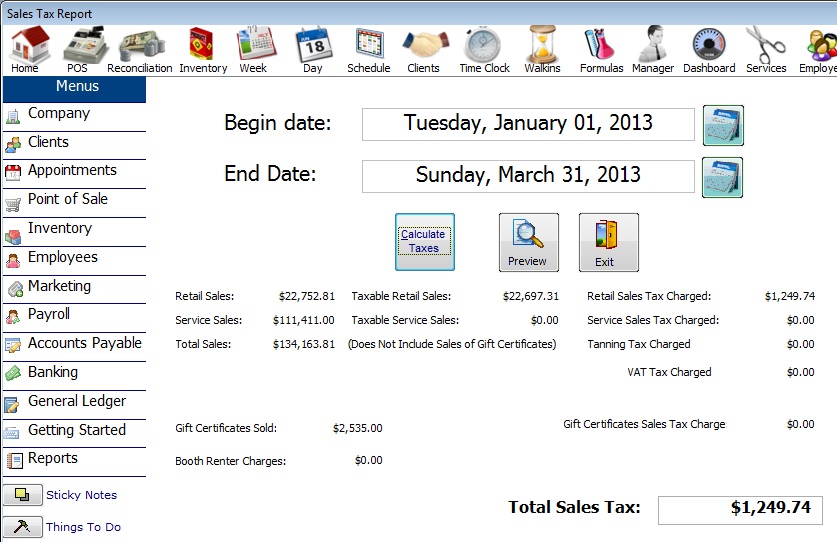

Advantage Salon and Spa Software has a complete sales tax reporting function. You will need to submit a sales tax report to your state and local authorities about the sales taxes you have collected

and the tax you owe. Most importantly you will need to report both taxable and non taxable sales, total sales, sales tax on retail items and sales tax on services. Since tax rates and rules are different from one location to another,

Advantage Software is flexible enough for you to setup the necessary tax rates you need. Advantage Software also calculates any additional sales taxes including tanning tax and VAT if necessary.

Advantage Software was designed from the input of many professionals but was designed by accounting experts so that you can easily and consistantly generate the report necessary to run your business, meet the expectations of government and respond to the needs of your employees and customers